Triangle Tweener Fund 2022 Results!

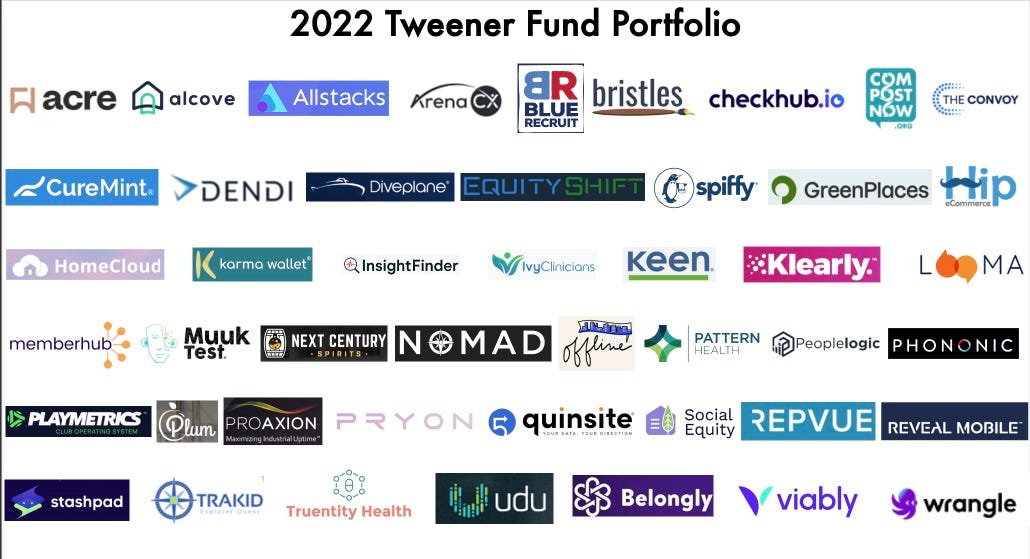

Tweener Fund deploys over $2.8m across 56 investments and 48 companies 🤯

Greetings Tweener List substack subscribers! First, let me address the most common question I get this time of year: When is the 2023 Triangle Tweener List going to be published?! Historically, my goal has been to get the list out in Q1. Last year I epic failed and it took till June. The good news is Robbie Allen is not only helping with Tweener Fund but Tweener List. We have a new site in the works, more automated systems and a lot more. I’m optimistic we’ll get the new list out in Q1, so stay tuned. we have 80 days left!

That being said, I wanted to share some big Tweener-related news!

Tweener Fund 2022

Today the Tweener Fund announced our Q4 14 investments and the 2022 first year results: 56 investments across 48 portfolio companies and over $2.8m deployed.

🤯🤯🤯🤯🤯🤯🤯🤯

When we started the Tweener Fund we had two big unknowns:

Would we be able to get accredited investors (LPs) to sign up for this idea of creating a mini venture fund to invest with a strategy of focusing on Triangle HQ’d cos, Tweeners and building an index (favor more small investments vs. fewer large investments like traditional VC).

Would we be able to find enough rounds to invest in and would the companies welcome us onto their capital tables?

I can say a year later the resounding answer to both questions is yes. The average Angel List rolling fund has $200k/Q and 20-50 LPs so that’s where we set our expectations. We ended 2022 with 128 LPs, over $750k/Q and we were able to invest in 48 companies!

A year alter, We want to say - thank you to everyone in the Triangle ecosystem for the incredible amount of support you gave us in year 1 to totally crush all expectations!

2022 Tale of the tape

Part of the goal of the Tweener Fund is to add transparency to the Triangle’s startup ecosystem, in that spirit, here are the details for the 2022 investments:

56 Investments made

48 Unique portfolio companies (8 investments were follow-on investments)

$2.8m invested

41 Tweener investments

15 Pre-Tweener investments

$49,975 average investment

$4.7m average round size

$33m average pre-money valuation (this skews high due to 3 later stage investments, for early-stage investments the pre-money valuation was in the $8-10m range)

Investment Format:

o Priced Round: 25 (45%)

o Convert: 15 (27%)

o SAFE: 16 (28%)

128 investors (LPs) that have made a $6.4m commitment

2023 Preview

What do you do after a great year? You double down and that’s what we’re doing. Our goal is to grow to > $1m/Q in investment, do slightly more investments, but now look at writing bigger checks. We’d love to move our average check up from $50k to $100k while continuing to make 10-15 investments a Q. If you’re interested in learning more or becoming an investor to help us achieve these goals, details are at www.tweenerfund.com

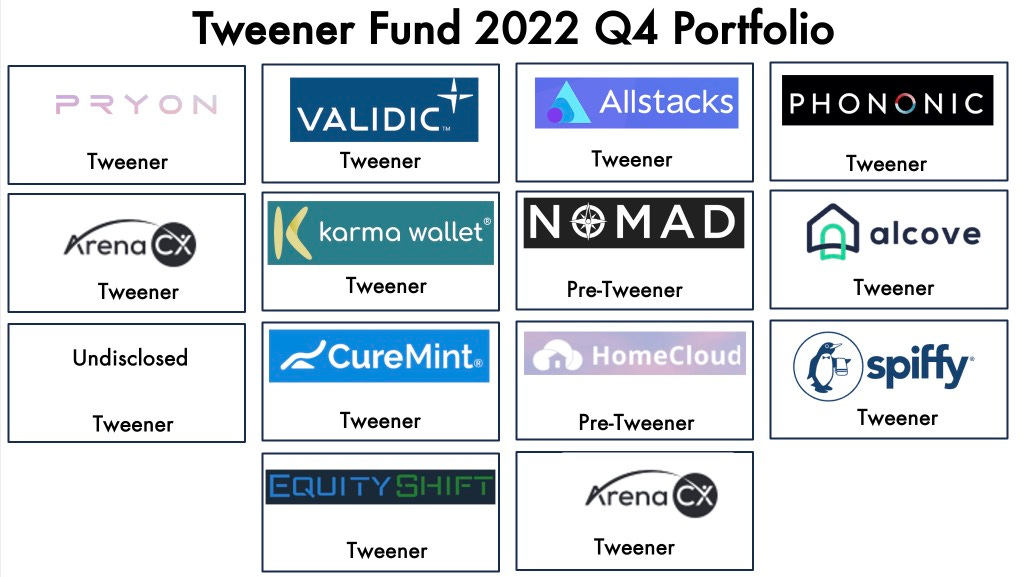

Q4 Tweener Fund Details

Here are the Q4 new portfolio companies (in order of investment):

Pryon (Tweener) – Founded by serial entrepreneur Igor Jablokov, Pryon has developed an enterprise AI engine that pulls in all of a company’s data and surfaces it via chat or voice to internal/external data workers.

Validic (Tweener) – Validic gives developers of healthcare applications (insurance, hospitals, etc.) an API that works with a wide range of healthcare wearables and the terabytes of data they produce.

Phononic (Tweener) – Phononic applies solid-state electronics to refrigeration, both eliminating the need for environment-harmful gases, and dramatically reduces the energy needed for a wide range of cooling applications.

Impact Karma (Tweener) - Providers of Karma Wallet, Impact Karma helps consumers understand and offset their shopping carbon footprint.

Nomad (Pre-Tweener) - Nomad is building a network of co-living villages with flexible furnished living for remote working digital nomads. Their first co-living village is being developed in Raleigh, NC.

Alcove (Tweener) – Alcove operates a marketplace where renters and owners can find roommates.

HomeCloud (Pre-Tweener) – Founded by serial entrepreneur, George Kirkland, HomeCloud is re-inventing the home inspection process so that a complete digital record stored in a convenient cloud application that current and future homeowners can utilize to maintain the home.

GetSpiffy (Tweener) – Spiffy is disrupting the car-care industry with digital and mobile solutions for consumers and fleets.

Equity Shift (Tweener) – Equity Shift provides private companies a comprehensive platform for managing fundraising, secondary sales, compliance, and vesting schedules.

Undisclosed (Tweener) – Tweener Fund invested In a Tweener in Q4 and the round has not been announced, we will reveal the investment if/when the round is announced.

In Q4, Tweener Fund also made follow-in investments in these existing portfolio companies:

AllStacks (Tweener) – AllStacks analyzes all the developer tools used by a company and surfaces a holistic view of project health for leadership.

ArenaCX (Tweener) – ArenaCX operates a marketplace that gives companies the ability to shop and procure various business-process-outsourcing options such as customer-service outsourcing.

CureMint (Tweener) – Curemint provides software for dental offices to manage their procurement and AP.

About the Triangle Tweener Fund

The Triangle Tweener Fund was founded in January 2022. It is a rolling fund that has a very narrow focus:

1. Companies must be headquartered in the Triangle

2. The fund invests 70%+ in early-stage, high-tech, ‘Tweener’ companies (10 people or $1m ARR)

3. The fund is building an index of Triangle Tweeners, so favors writing more ‘small’ checks vs. the traditional venture model of fewer large checks

4. Our accredited investors (LPs) are top entrepreneurs, service providers and other participants in our startup ecosystem and are not only looking for great returns, but also see the opportunity to accelerate the Triangle startup ecosystem flywheel.

Triangle Tweener Fund is managed by two serial entrepreneurs who are the General Partners (GPs): Scot Wingo and Robbie Allen. Tweener Fund leverages the Angel List ‘rolling fund’ platform. The minimum investment is $20,000 (4 quarterly investments of $5k for the first year) and then ‘rolling’ (quarter-to-quarter) thereafter. In its first year, Tweener fund invested over $2.8m across 48 portfolio companies.

More information can be found at www.tweenerfund.com