Triangle Tweener News: Tweener Fund Q3 Portfolio released!

Record > $700k deployed across 16 investments!

Greetings Triangle Tweener Substack subscribers. Today, the Triangle Tweener Fund is announcing our robust set of Q3 portfolio companies. Now that we’re 9 months into the fund, we’re convinced our thesis that building an index of Triangle HQ’d companies with a focus on Tweeners is both a smart angel investing strategy, but also, over the medium/long-term will accelerate our startup ecosystem flywheel.

The Triangle Tweener Fund has a transparent four-pronged strategy:

Triangle geography - The company has to be headquartered in the Triangle.

Index strategy – We are building an index of Triangle startup investments. If you look at the returns of early-stage investing they are distributed on a power-law curve. This means that mathematically it’s important to never miss a winner. There’s a great article on this concept here.

Tweeners – The majority of our investments meet the Tweener criteria: $1m/yr of revenues or 10 team members.

Flywheel – Long-term we believe the Tweener fund will accelerate our startup ecosystem flywheel. Successful founders will become LPs, their investment will fuel the next set of Tweeners, those Tweeners will have exits, rinse-and-repeat.

The Big Picture

We launched the Tweener Fund in January of 2022 with this strategy with the biggest unknown being: ‘are there enough companies raising capital each Q to make ~10 investments. Well 9 months into it, I can tell you that is no longer a concern - in fact we could easily be doing 5-10 more investments per Q and investing more.

So far, we’ve deployed over $2m into 38 companies, we have over 100 investors featuring a ‘Who’s who’ of the Triangle startup ecosystem and we have over $5m committed.

The Tweener Fund is on the Angel List rolling fund so it’s like a quarterly subscription and the minimum commitment is $5k/Q for a yr ($20k total).

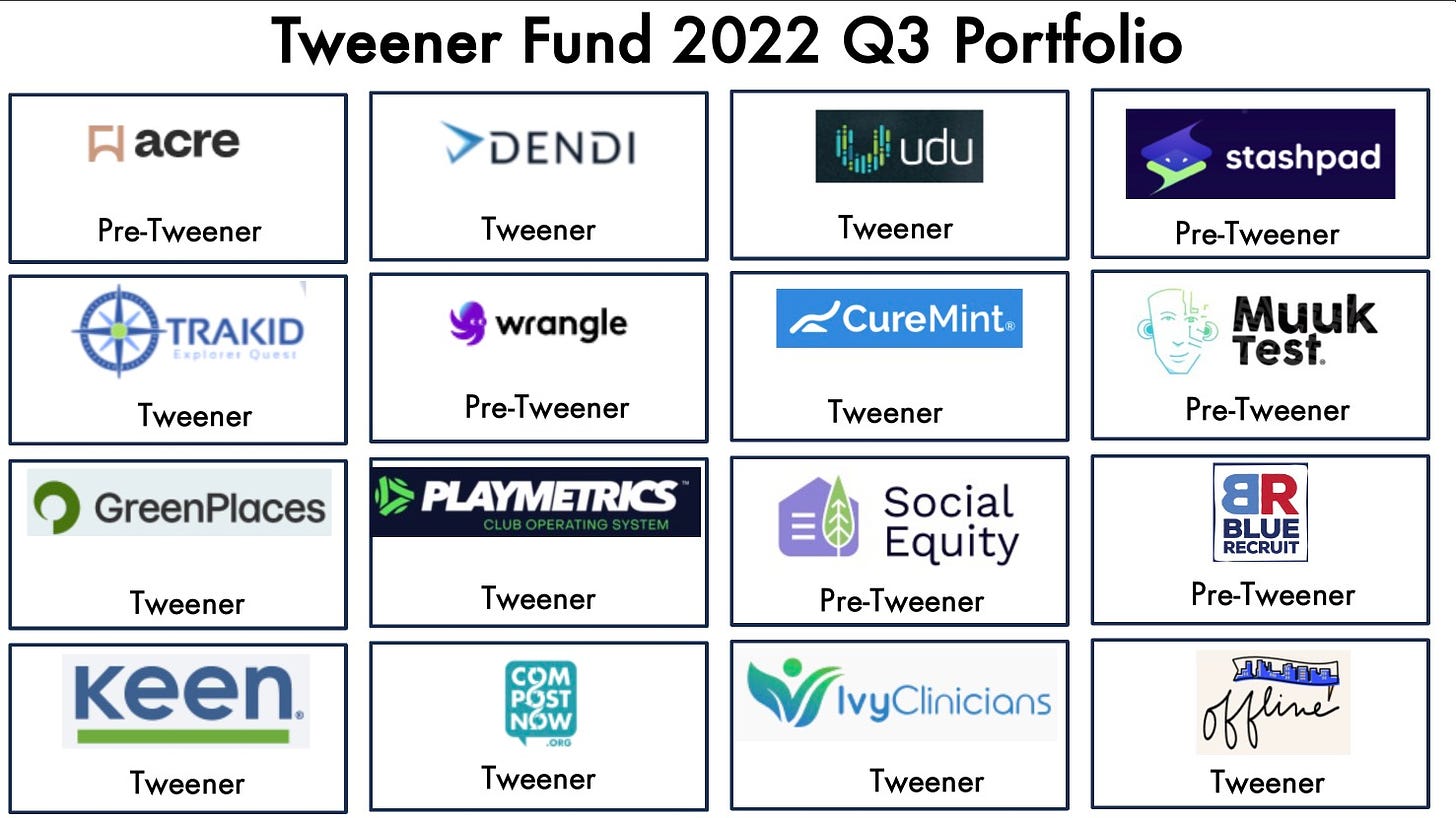

Introducing the Q3 portfolio:

The 16 investments this quarter are:

Here are the Q3 new portfolio companies with details (in order of investment):

Acre (Pre-Tweener) – Serial entrepreneur Mike Schneider (First) has an interesting take on fractional ownership. What if you could co-own your home with a financial sponsor that’s not a traditional mortgage? Acre is working on building a marketplace to bring home buyers and financial sponsors together.

Dendi (Tweener)- Dendi offers a LIS (Lab Information Software) system for clinics that run clinical trials. Dendi has been under the radar executing and growing revenue and making customers happy.

Udu (Tweener) – Udu has built a machine learning platform that helps Private Equity (PE) firms to source, learn more and track potential investments.

Stashpad (Pre-tweener) – Founded by CEO Cara Borenstein, Stashpad is building an essential developer notepad.

TRAKID (Tweener) – TRAKID provides theme park, zoo and other experience venues with an IoT and phone enabled child-oriented experience that not only tracks children so they won’t get lost. On top of that, there are treasure hunts and other adventures that make the park experience educational and fun.

Wrangle (Pre-Tweener)- Many modern teams use Slack, but after the salesforce acquisition, Slack hasn’t been innovating. Wrangle builds innovative solutions on top of slack including a robust ticketing system.

CureMint (Tweener)- Dentist offices need a lot of help procuring all the different supplies that go into operating a business that sees hundreds of patients a week. On top of ‘repleneshables’, CureMint helps offices acquire larger more expensive equipment.

Muuk Test (Pre-Tweener) – Modern agile teams are moving so fast, Quality Assurance (QA) is frequently left by the side. Muuk Test has developed technology that allows teams to get to 95% coverage with automatically generated tests.

Green Places (Tweener) – Alex Lassiter left the Triangle (UNC grad) for the ATL where he co-founded Gather (software for the restaurant industry) and then sold it after ~8yrs. That prompted him to move back to the Triangle where he met Jess Lipson (ShareFile/Levitate). Together they came up with the idea for Green Places – a platform for SMBs to measure and track their carbon footprint while also helping with offsets.

Playmetrics (Tweener) – Founded by serial entrepreneur, Mike Doernberg, Playmetrics is modern software for club sports and leagues to manage their teams, stats and more.

Social Equity (Pre-Tweener) – CEO Brian Lora was CTO at SageWorks and has started Social Equity. SE has a proprietary platform and technology to bring fractional ownership to more home owners.

Blue Recruit (Pre-Tweener) – Most of the HRTech on the market is geared towards college-degreed professionals. What if you want to recruit trades people? Blue Recruit is building HRTech for recruiting trades people.

Keen (Tweener) – Keen uses predictive modeling to enable marketers to run what-if scenarios around marketing mix, funnel optimization, etc.

CompostNow (Tweener) – CompostNow helps individuals and businesses implement compost programs that reduce waste and increase nutrient rich soil.

Ivy Clinicians (Pre-Tweener) – Ivy Clinicians is building a vertical recruiting/hiring marketplace for the emergency medicine employer and employee.

Offline Media (Tweener) – Offline Media has created a hyper-local two-sided marketplace. On one side are millennials and GenZ consumers looking to have new local, exclusive, curated eperiences and perks. On the other side of the marketplace are local merchants (restaurants, etc.) looking to mee this coveted demographic and explose them to their offerings. The Offline Media CEO is David Shaner. The Tweener Fund initially invested in Offline in Q1 and this investment supports a new round.

Anyone interested in learning more about the Tweener Fund can find the detailed portfolio, pitch deck/video and more at www.tweenerfund.com. We are actively accepting new investor applications (Limited Partner).

Robbie Allen and Scot Wingo are the General Partners (GP) for TweenerFund. The TweenerFund has no management fee and uses the AngelList rolling fund model. The minimum investment is $20,000 for the first year - $5k/Q for 4 Quarters. LPs must be accredited investors.