Tweener News: Tweener Fund Q2 and Robbie Allen...

Robbie Allen joins Tweener Fund as General Partner + 12 New Triangle HQ'd Portfolio companies!

Greetings Triangle Tweener subscribers, I hope everyone's Summer is going well and you enjoyed some fireworks, and other Americana this 4th!

If you missed it, the 2022 Tweener list was published in June and lives here.

I started the Tweener Fund, a rolling venture fund to invest exclusively in Triangle based startups (majority Tweeners) in January of this year and, well, pardon the Dad joke here, but it has been on roll. We’ve raised 4x my expectation and invested over $1.3m in 24 companies in just 6 months - THIS is why I love our startup community.

Sidebar: The Tweener Fund is accepting investors (LPs), you have to be an accredited investor and we kept the minimum very low at $20k commitment for a year - paid in $5k/Q increments. To learn more: tweenerfund.com

In the first 6 months, what I realized is I need some help and as that realization dawned on me, Robbie Allen reached out and said - I want to do more. (Chinese proverb: Be careful what you ask for!). Robbie and I have known each other for > 15yrs and worked together when I was on the board of Automated Insights, his first of many Triangle startups.

Today we announced that Robbie is joining the Tweener Fund as a General Partner. In addition to helping find companies to invest in, and meet with potential LPs, Robbie is going to apply his super-high-IQ brain on testing some AI/ML ideas we have around the venture/early stage company space. Stay tuned for more on that.

Tweener Fund Q2 Investments

In addition to the Robbie news, we dropped our Q2 Tweener Fund investments. In Q2 we made 14 investments, across 12 companies and deployed over $800k in fresh capital into these Triangle headquartered early stage companies. As you’ll see most of these are on the Tweener list, so you can check out more about them over there, but in this newsletter I provide a quick Tweener Fund oriented write up you may enjoy. I believe strongly these early stage startups are our future Pendos, Bandwidths and Red Hats and as a community we need to help however we can to get them there.

Here are the Tweener Fund Q2 Portfolio companies→

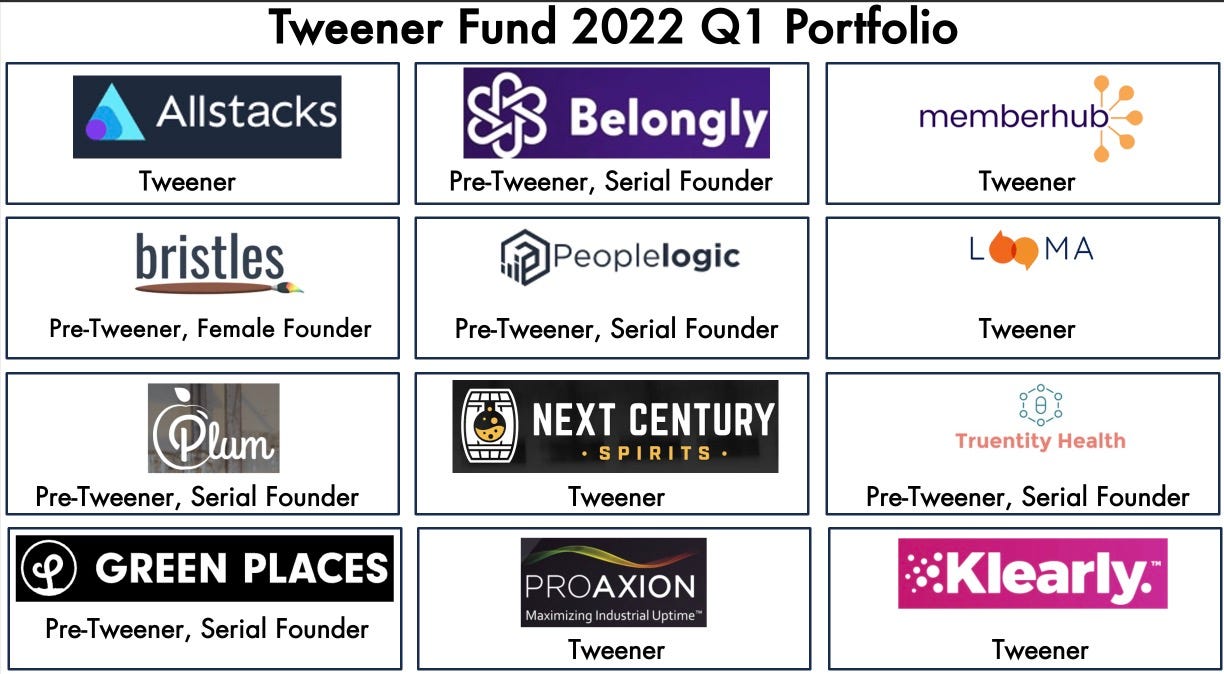

As a reminder here are the Q1 investments→

And if your interested the next section has details.

Tweener Fund Q2 Portfolio Deep Dive

ArenaCX (Tweener)- ArenaCX is a spin-out of Bandwidth/Republic Wireless. Led by CEO Alan Pendleton, they have created software and a marketplace that helps companies manage their outsourced call center acquisition, procurement, and ongoing management.

Offline Media (Tweener)- Offline Media has created a hyper-local two-sided marketplace. On one side are millennials and GenZ consumers looking to have new local, exclusive, curated experiences and perks. On the other side of the marketplace are local merchants (restaurants, etc.) looking to meet this coveted demographic and expose them to their offerings. The Offline Media CEO is David Shaner.

ChekHub (Tweener) - Founded by Jon Trout based on his experience helping Google rollout their fiber, ChekHub provides companies with w2/1099 field operations staff software to manage three components of that complex business operation. 1. Recruitment, training, deployment, and measurement of field operators. 2. Asset tracking 3. Install and support/maintenance ticket tracking. While there are systems that do each of these, nobody has put them together in one system for this vertical.

Convoy (pre-tweener) - Founded by serial entrepreneur Yasin Abbak, Convoy was founded based on Yasin’s personal experience watching his father operate a small business. Convoy seeks to bring modern procurement technology and leverage to small businesses. Their first vertical solution is group buying in the dental segment.

RepVue (Tweener) - Founded by ChannelAdvisor CRO Ryan Walsh, RepVue has built a two-sided vertical talent marketplace. On one side are individual sales reps that are looking for opportunities that meet their criteria around total comp, base/variable, deal-size, industry, and other factors important to sales reps. Companies looking to expand/upgrade their sales talent are on the other side of the marketplace. Additionally, the companies can get a real-time ‘health of the sales org’ and compare their various ratings to other cohorts.

Hip Ecommerce (Tweener)- Collectibles are a > $400b market that is underserved by legacy marketplaces like eBay. Founded by collectible enthusiast and serial entrepreneur Mark Rosenberg, Hip Ecommerce operates vertical collectible marketplaces (Stamps, postcards, and comics) that have a deep vertical experience for the collector in each category. For example, comic collectors frequently are looking for a specific range of CGC grades and HipComics allows you to search and buy that way.

Pattern Health (Tweener)- Led by Ed Barber and Tim Horan, Pattern Health is a HealthTech company that accelerates digital health innovation. They do this by taking electronic records, clinical data and other critical health data that is hard to access, aggregating it and making it available to researchers, clinical organizations, and others through a set of microservices/APIs. Think of Pattern Health as Twilio/Stripe for healthcare data. Pattern Health had a busy Q - Tweener Fund invested in a convertible note and a priced round with a sidecar SPV for interested LPs.

Quinsite (Tweener) - Jeff Maze worked for a consulting firm that built unified analytics for a variety of different healthcare organizations. Quinsite was founded to build a comprehensive healthcare analytics platform that is actionable. For example, are the members of your healthcare provider team meeting the right number of clients and getting great reviews?

InsightFinder (Tweener) - Today’s SaaS businesses have complex hosting and development environments. Managing that is a role called DevOps (Development and site/app Operations). Companies are investing heavily in this role and tooling. InsightFinder, founded by Helen Gu (national expert in predictive analytics and distributed systems from NCSU) has built the Unified Intelligence Engine (UIE). UIE is an AI system that monitors all a company’s systems, logs and even DevOp engineering communications to then predict problem areas and root cause analysis. Imagine the UIE saying: “Hey Bob, server number 10 is acting wonky, you should look into that before it becomes a problem”. Sounds like sci-fi right? Hope, it’s InsightFinder.

Viably (Tweener) - Serial entrepreneur Doron Gordon (sold Samanage to SolarWinds) is back with Viably. Viably is a FinTech that provides SMBs a platform for managing their finances. It starts with all-in SMB-friendly banking, insights and to get paid faster.

Klearly (Tweener) - Klearly was a previous Q1 investment that raised an additional round the Tweener Fund participated in for Q2 and led a SPV vehicle for our interested LPs.

Diveplane (Tweener) - One of the scariest AI stories is when Google developed an AI that could beat the best humans at the game GO, but they didn’t know how the AI came up with its strategy. Diveplane, led by former Epic Games President, Michael Capps, creates solutions that leverage the latest AI technology, but always making sure there are breadcrumbs to understand what the AI is doing and why.

Reveal Mobile (Tweener) - Founded by serial entrepreneur, Brian Handly, Reveal Mobile aggregates anonymized mobile device location data to measure, optimize and expand their online->offline advertising. For example, let’s say you have a billboard on Capital Bld. Reveal allows you to measure the number of consumers that drove past that billboard and then measured your store in the last 30 days compared to a period before/after the billboard.

That’s all for this post, thanks everyone!